Dynamic tax analysis assumes

A. all of the present tax rates will be in place for a minimum of twenty years.

B. changes in the tax rates have no effect on tax revenue.

C. changes in the tax rates have no effect on the tax base.

D. changes in the tax rates will change the tax base.

Answer: D

You might also like to view...

With perfect price discrimination, the quantity of output produced by a monopoly is ________ the quantity produced by a perfectly competitive industry

A) greater than but not equal to B) less than C) equal to but not greater than D) not comparable to E) either greater than or equal to

There is no possible economic relationship between the birth rate and the availability of arable land

Indicate whether the statement is true or false

Competitive markets generally give consumers and producers correct incentives when

a. externalities are present in the market. b. property rights are well-defined and enforced. c. the good being produced and consumed is a pure public good. d. there is a substantial lack of information on the part of either buyers or sellers.

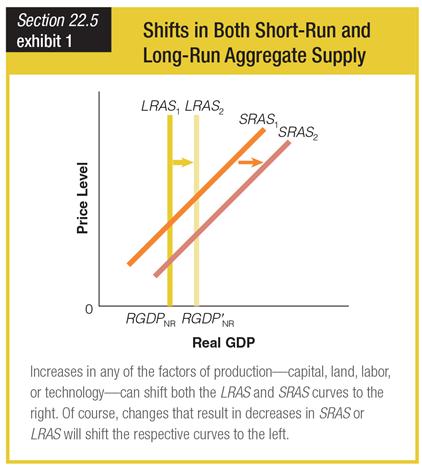

Which of the following statements accurately describes the situation shown?

a. a movement along the short-run aggregate supply curve and an upward shift in the long-run aggregate supply curve

b. a rightward shift in the short-run aggregate supply curve and a rightward shift in the long-run aggregate supply curve

c. a movement along the long-run aggregate supply curve and no change in the short-run aggregate supply curve

d. a leftward shift in the long-run aggregate supply curve and a rightward shift in the short-run aggregate supply curve