On January 1, 2016, Leffler, Inc sold $200,000 of its convertible bonds at par. Conversion terms allow each $1,000 bond to be converted into 40 common shares. On April 1, 2018, the company increases the conversion terms to 55 shares per bond if conversion takes place within 180 days. The conversion of all of the bonds took place on May 1, 2018. Fair market values of the common stock were as

follows: January 1, $20; April 1, $30; and May 1, $25. The bond conversion expense would be recorded at

A) $60,000.

B) $75,000.

C) $90,000.

D) $105,000.

B

You might also like to view...

Business markets have several characteristics that contrast sharply with those of consumer markets. Name and briefly characterize five of those characteristics

What will be an ideal response?

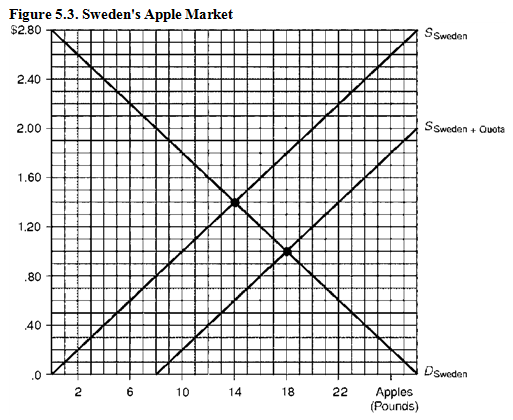

Consider Figure 5.3. In the absence of trade, Sweden's equilibrium price and quantity of apples would be

a. $0.60 and 22 pounds.

b. $0.60 and 14 pounds.

c. $1.00 and 18 pounds.

d. $1.40 and 14 pounds.

The three-tier application model is also referred to as a client/server application.

Answer the following statement true (T) or false (F)

Robyn's Retail had 400 units of inventory on hand at the end of the year. These were recorded at a cost of $15 each using the last-in, first-out (LIFO) method. The current replacement cost is $13 per unit

The selling price charged by Robyn's Retail for each finished product is $22. In order to record the adjusting entry needed under the lower-of-cost-or-market rule, the Merchandise Inventory will be ________. A) debited by $5,200 B) credited by $5,200 C) debited by $800 D) credited by $800