Assume that you have been given the task of assisting a company in designing its marketing planning process. What components should be in such a process?

What will be an ideal response?

The marketing planning process consists of analyzing marketing opportunities, selecting target markets, designing strategies, developing marketing programs, and managing the marketing effort.

You might also like to view...

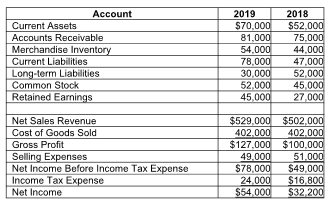

With respect to current liabilities, a horizontal analysis reveals ________. (Round your answer to two decimal places.)

The following is summary of information presented on the financial statements of a company on

December 31, 2019.

A) that current liabilities are 38.05% of total equity

B) a 65.96% increase in current liabilities

C) a current ratio of 0.90

D) a 39.74% increase in current liabilitiesA) that current liabilities are 38.05% of total equity

B) a 65.96% increase in current liabilities

C) a current ratio of 0.90

D) a 39.74% increase in current liabilities

Which of the following statements is consistent with principle-based ethics?

A. Although certain acts are wrong, they should be performed for the overall happiness they may produce. B. An act that produces the greatest beneficial consequences is the ethically right thing to do. C. Obligations, responsibilities, and commitments do not determine the correct approach to ethics. D. Individuals have rights that should not be sacrificed in order to generate a net increase in the collective good.

The use of a discounts lost account implies that the recorded cost of a purchased inventory item is its

a. invoice price. b. invoice price plus the purchase discount lost. c. invoice price less the purchase discount taken. d. invoice price less the purchase discount allowable whether taken or not.

Which of the following statements is CORRECT?

A. If a stock has a required rate of return rs = 12% and its dividend is expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%. B. The stock valuation model, P0 = D1/(rs? g), can be used to value firms whose dividends are expected to decline at a constant rate, i.e., to grow at a negative rate. C. The price of a stock is the present value of all expected future dividends, discounted at the dividend growth rate. D. The constant growth model cannot be used for a zero growth stock, where the dividend is expected to remain constant over time. E. The constant growth model is often appropriate for evaluating start-up companies that do not have a stable history of growth but are expected to reach stable growth within the next few years.