When the Fed changes the quantity of money, there is an immediate effect on

A) the inflation rate but not the price level.

B) the nominal interest rate.

C) real GDP.

D) the price level and the inflation rate.

E) the price level but not the inflation rate.

B

You might also like to view...

If expectations about future income change, there is

A) a decrease saving if people expect income to decrease in the future. B) a decrease in saving if people expect income to increase in the future. C) an increase in saving if people expect income to increase in the future. D) no change in saving until income actually changes. E) a change in the quantity of loanable funds supplied and a movement along the supply of loanable funds curve.

For an individual who consumes only two goods, x and y, the opportunity cost of consuming one more unit of x in terms of how much y must be given up is reflected by:

a. the individual's marginal rate of substitution. b. the market prices of x and y. c. the slope of the individual's indifference curve. d. none of the above.

The velocity of money is defined as: a. the time it takes the average worker to get to the bank with his/her paycheck

b. the time it takes banks to clear checks. c. the average number of times per year each dollar is used to purchase final goods and services. d. the ratio of money supply to the average price level in an economy. e. the average number of times per year each dollar is spent for goods, payrolls, Social Security payments, etc.

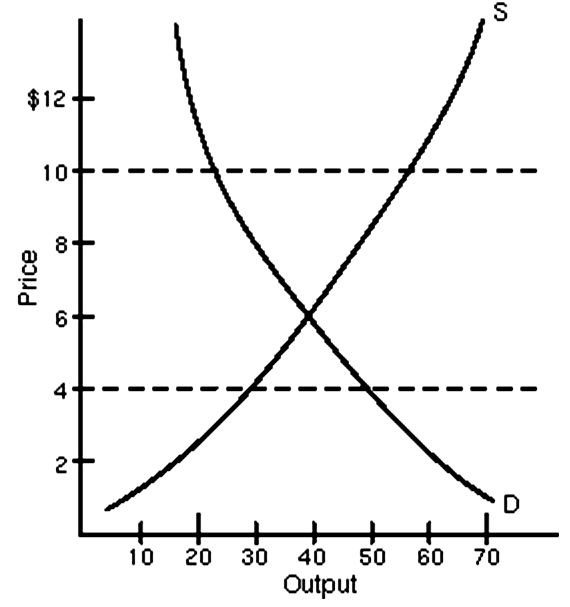

The price of $4 in the graph above represents

A. a price floor.

B. a price ceiling.

C. either a price floor or a price ceiling.

D. neither a price floor nor a price ceiling.