Suppose that expected profit decreases. This change means

A) the demand curve for loanable funds shifts leftward and the real interest rate falls.

B) the supply curve for loanable funds shifts rightward and the nominal interest rate rises.

C) there is a movement down along the demand curve for loanable funds.

D) the real interest rate rises as saving increases.

A

You might also like to view...

Why is investing in technology a better option than investing in labor or capital as a means to sustained growth?

What will be an ideal response?

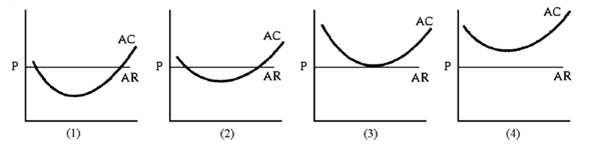

Figure 7-13

A. All of them B. Only 2 C. Only 3 D. Cannot determine with information given

How can the Fed increase the money supply? How can the Fed decrease the money supply? Be specific

The government budget constraint implies that

A. government borrowings = government spending+ transfers - taxes and user charges. B. government spending = government borrowing - transfers - taxes and user charges C. government spending = transfers - taxes and user charges - government borrowing. D. government borrowings = taxes and user charges + government spending - transfers