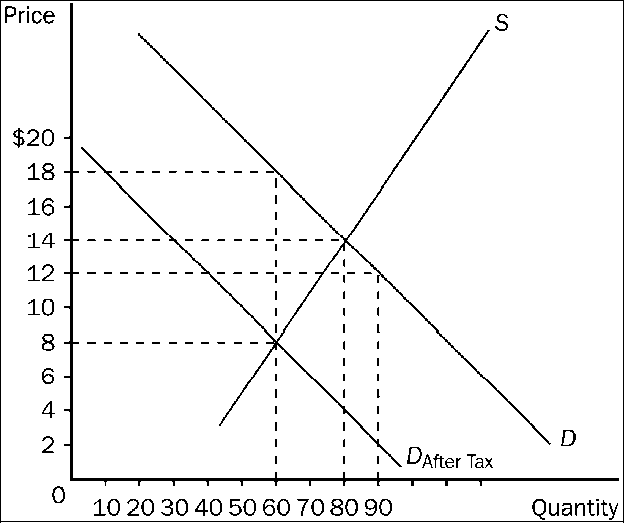

Figure 4-21

Refer to . The per-unit burden of the tax is

a.

$4 on buyers and $4 on sellers.

b.

$5 on buyers and $5 on sellers.

c.

$4 on buyers and $6 on sellers.

d.

$6 on buyers and $4 on sellers.

c

You might also like to view...

The quantity of goods and services that can be produced by one worker or by one hour of work is known as

A) per-capita GDP. B) labor productivity. C) real domestic output. D) the labor force participation rate.

Consider a firm with the following cost and revenue information: ATC = $20, AVC = $10, and P = MR = $30 . If the firm follows the rule to maximize profits, its output level is 3 . Therefore MC equals

a. $20 b. $10 c. $30 d. $90 e. $3

Suppose that the market for haircuts in a community is perfectly competitive and that the market is initially in long-run equilibrium. Subsequently, an increase in population increases the demand for haircuts. In the short run, we expect that the typical firm is likely to begin:

Select one: A. incurring an economic loss. B. experiencing neither an economic profit nor an economic loss. C. earning an economic profit. D. experiencing no change in its economic profit.

Define the field of economics known as macroeconomics.

What will be an ideal response?