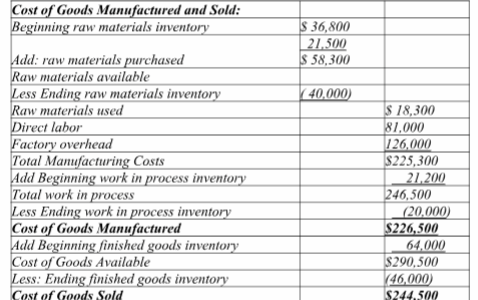

Information for Maxim Manufacturing is presented below. Compute both the cost of goods manufactured and the cost of goods sold for Maxim Manufacturing.

You might also like to view...

Steinhoff Products, Inc., has a Sensor Division that manufactures and sells a number of products, including a standard sensor that could be used by another division in the company, the Safety Products Division, in one of its products. Data concerning that sensor appear below: Capacity in units 51,000Selling price to outside customers$56Variable cost per unit$37Fixed cost per unit (based on capacity)$14?The Safety Products Division is currently purchasing 4,000 of these sensors per year from an overseas supplier at a cost of $48 per sensor.?What is the maximum price that the Safety Products Division should be willing to pay for sensors transferred from the Sensor Division?

A. $14 per unit B. $51 per unit C. $37 per unit D. $48 per unit

When a seller requires its dealers to abstain from handling competitors' products, it is called ________

A) subjective distribution B) exclusive dealing C) selective distribution D) exclusive pricing E) disintermediation

Depreciation is:

A) the process of systematically and rationally allocating the cost of a fixed asset over its useful life. B) an accumulation of funds to replace the related plant asset. C) the difference between the replacement cost and salvage value of an asset. D) the cash allocated each period to maintain a plant asset.

What kind of sentence reveals the main idea of a paragraph?

A) Pivoting B) Supporting C) Topic D) Transitional