Marcus earned $54,000 last year when the Social Security tax was 6.2% of income up to $94,200. His Medicare tax was 1.45%. How much did he pay in Social Security and Medicare taxes last year?

What will be an ideal response?

$4,131; 54,000(0.062 + 0.0145) = $4,131

Mathematics

You might also like to view...

Use a calculator to find the function value to four decimal places.cot (-659°)

A. -0.0175 B. 0.6009 C. 1.8041 D. 0.5543

Mathematics

Solve the investment problem.Mardi received an inheritance of $70,000. She invested part at 11% and deposited the remainder in tax-free bonds at 10%. Her total annual income from the investments was $7400. Find the amount invested at 11%.

A. $62,600 B. $20,000 C. $39,000 D. $40,000

Mathematics

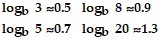

Use the following approximations to find the approximate value of the logarithmic expression:  logb40

logb40

A. 13 B. 40 C. 0.63 D. 1.6

Mathematics

Use the product-to-sum formulas to rewrite the product as a sum or difference.

?

A. ?

B. ?

C. ?

D. ?

E. ?

Mathematics