Trudy and Uri enter into a contract for the sale of Trudy's house for which Uri agrees to pay her $200,000. Uri wants to transfer his right to the ownership of the house to Val, his niece. This transfer

A. is prohibited.

B. may be oral or written.

C. must be implied.

D. must be in writing.

Answer: D

You might also like to view...

A marketer who is using a reliable marketing information system to monitor the marketing environment so s/he can assess market potential and demand is focused on capturing marketing insights

Indicate whether the statement is true or false

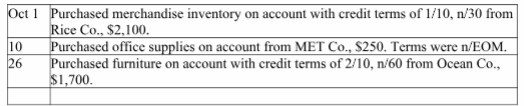

Golden Company had the following transactions:

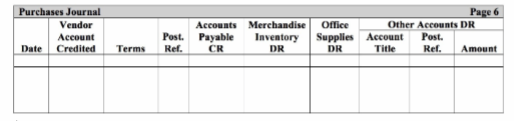

Use the following purchases journal to record the preceding transactions. The company uses a perpetual inventory system.

Nonrefundable credits are those that reduce the taxpayer’s tax liability but are not paid when the amount of the credit (or credits) exceeds the taxpayer’s tax liability.

Answer the following statement true (T) or false (F)

A quarterly report filed with the Securities and Exchange Commission is called a Form 10-K

Indicate whether the statement is true or false