Long-term debt has a maturity that is

A) between one and ten years.

B) less than a year.

C) between five and ten years.

D) ten years or longer.

D

You might also like to view...

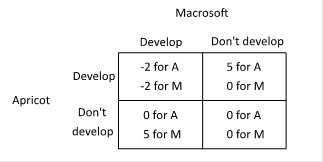

Suppose two companies, Macrosoft and Apricot, and considering whether to develop a new product, a touch-screen t-shirt. The payoffs to each of developing a touch-screen t-shirt depend upon the actions of the other, as shown in the payoff matrix below (the payoffs are given in millions of dollars).  Suppose Apricot makes its decision first, and then Macrosoft makes its decision after seeing Apricot's choice. What will happen if, before Apricot chooses, Macrosoft announces that it is going to develop a touch-screen t-shirt no matter what Apricot does?

Suppose Apricot makes its decision first, and then Macrosoft makes its decision after seeing Apricot's choice. What will happen if, before Apricot chooses, Macrosoft announces that it is going to develop a touch-screen t-shirt no matter what Apricot does?

A. Neither Apricot nor Macrosoft will develop a touch-screen t-shirt because they will both realize that they are in a no-win situation. B. Apricot will develop a touch-screen t-shirt, and Macrosoft will not because Macrosoft's threat is not credible. C. Macrosoft will develop a touch-screen t-shirt, and Apricot will not because it's not in Apricot's interest to develop a touch-screen t-shirt if Macrosoft also develops one. D. Both Apricot and Macrosoft will develop a touch-screen t-shirt because neither company will want to back down.

All of the following are elements in the structure of the Fed EXCEPT the

A) 12 Federal Reserve Banks. B) presidents of the 12 Federal Reserve Banks. C) Executive Council to the Governor. D) Board of Governors. E) Federal Open Market Committee.

Which of the following would increase the supply of laptop computers?

A. Higher wage rates for the workers that produce laptop computers. B. A technological improvement that lowers the cost of producing laptop computers. C. An increase in the price of computer chips used to produce laptop computers. D. An increase in the price of laptop computers.

If firms in a competitive market are identical, the long-run market supply curve is horizontal

Indicate whether the statement is true or false