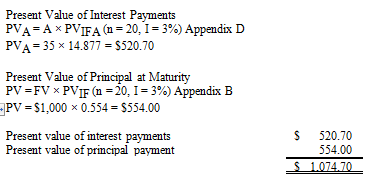

A 10-year bond, with a par value equaling $1,000, pays 7% annually. If similar bonds are currently yielding 6% annually, what is the market value of the bond? Use semiannual analysis. Use time value of money tables in Appendix B and Appendix D.

A) $700.00

B) $927.50

C) $1,074.70

D) $1,520.70

C) $1,074.70

All else being equal, when the yield to maturity is less than the coupon/face rate, the bond will be priced above par:

You might also like to view...

_____ occurs when competitors within an industry cooperate illegally for mutual benefit.

a. Collusion b. Bribery c. Corruption None of the above

Similar to the United States Supreme Court, decisions of the European Court of Justice are issued with the dissenting opinions of the minority ruling judges which are not open to the general public

Indicate whether the statement is true or false

OLTP systems are designed to handle ad hoc analysis and complex queries that deal with many data items

Indicate whether the statement is true or false

The process of verifying the real identity of an individual, computer, computer program, or EC Web site best describes

A) integrity. B) availability. C) authentication. D) nonrepudiation.