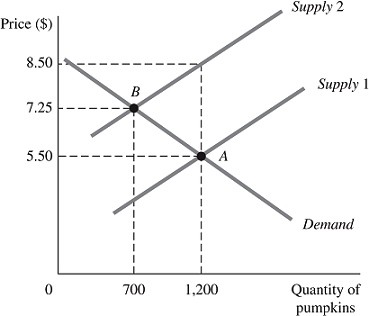

Refer to the information provided in Figure 5.7 below to answer the question(s) that follow.

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. Had the demand for pumpkins been perfectly inelastic at Point A, the amount customers would have paid per pumpkin after the imposition of this tax would have been

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. Had the demand for pumpkins been perfectly inelastic at Point A, the amount customers would have paid per pumpkin after the imposition of this tax would have been

A. $0.

B. $5.50.

C. $7.25.

D. $8.50.

Answer: D

You might also like to view...

Table 11-1 Y = C + I + G C = 500 + 0.8(Y?T) I = 300 G = 700 T = 0.25Y Refer to Table 11-1. What is the level of consumption in this model?

A. 2,950 B. 2,750 C. 2,550 D. 2,350 E. 2,150

"Price discrimination allows a monopoly to increase its economic profit by capturing part of the consumer surplus and turning it into economic profit

" Is the previous statement correct or incorrect? If the statement is correct, why is it important in understanding firms' behaviors? If it is incorrect, why is it incorrect?

Is there any case for legalizing drugs?

What will be an ideal response?

Under democratic representative government, spending on a government program will likely be larger than the amount consistent with economic efficiency when

a. tax costs are levied in direct proportion with the benefits received. b. both the costs and benefits are widespread among the voters. c. benefits of the program are highly concentrated, while the costs are widely dispersed among voters. d. costs of the program are highly concentrated, while the benefits are widely dispersed among voters.