Suppose the interest parity condition holds. Also assume that the one-year interest rate in the United States is 6% and that the one-year interest rate in Canada is 5%. What does this imply about the current versus future expected exchange rate (for the U.S. and Canadian dollars)? Explain

What will be an ideal response?

If the interest rate in US is greater than the interest rate in Canada, we know that Canadian dollars must be expected to appreciate to equate the expected returns on the two bonds.

You might also like to view...

Use the following data to answer the next question. The disposable income (DI) and consumption (C) schedules are for a private, closed economy (an economy with no government and no international trade). All figures are in billions of dollars.Disposable IncomeConsumption$300$310350340400370450400500430If disposable income is $550, we would expect consumption to be

A. $430. B. $460. C. $450. D. $470.

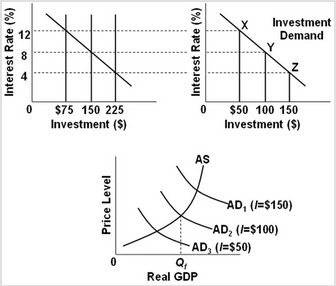

Use the following graphs to answer the next question. In the graphs, the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the level of investment spending associated with each curve. All figures are in billions. The economy is at point Z on the investment demand curve. Given these conditions, what policy should the monetary authorities pursue to achieve a noninflationary, full-employment level of real GDP?

In the graphs, the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the level of investment spending associated with each curve. All figures are in billions. The economy is at point Z on the investment demand curve. Given these conditions, what policy should the monetary authorities pursue to achieve a noninflationary, full-employment level of real GDP?

A. Sell government securities in the open market. B. Decrease the reserve requirement. C. Decrease the discount rate. D. Make no change in monetary policy.

Inaccurate prediction generally invalidates the use of theory in economics.

Answer the following statement true (T) or false (F)

Refer to the information above. Given this information, we know that effective labor (NA) grows at which rate?

A) 0 B) 1% C) 4% D) 5% E) 15%