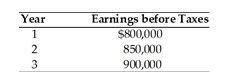

) Maxi, Inc. is evaluating the acquisition of Mini, Inc., which had a loss carryforward of $2.75 million which resulted from earlier operations. Maxi can purchase Mini for $3.5 million and liquidate the assets for $1.25 million. Maxi expects earnings before taxes in the three years following the acquisition to be as follows:

(These earnings are assumed to fall within the limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Maxi has a 40 percent tax rate and a cost of capital of 10 percent. The total present value of tax advantage of the acquisition in the following three years is ________.

A) $440,374

B) $842,374

C) $1.1 million

D) $2.75 million

B) $842,374

You might also like to view...

Which of the following are visible signs of emotions and, in some instances, may in fact be the cause of emotions?

A. friends B. biting into something disgusting C. facial expressions D. ulcers

All of the following would denature a protein except

A. addition of a strong acid. B. a missing coenzyme. C. addition of a strong base. D. heating to temperatures above 100°C.

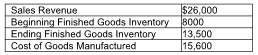

Compute cost of goods available for sale.

Fontana Manufacturing provided the following information for the month ended March 31:

A) $15,600

B) $29,100

C) $23,600

D) $10,100

________ is a measure of variation in Y that is explained by the independent variable X

A) eta2 (?2 ) B) SSx C) SSy D) SSwithin