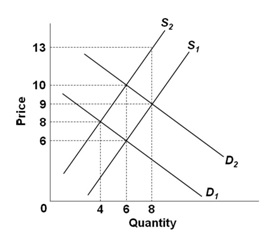

Refer to the below graph. Assume the market for this product started out at the intersection of D2 and S1. Then supply shifted from S1 to S2 due to an excise tax imposed on the product. If demand subsequently shifts from D2 to D1, then which of the following will decrease?

A. The tax per unit of the product

B. The tax revenue

C. The deadweight loss due to the tax

D. The portion of the tax per unit that is shouldered by the buyers

B. The tax revenue

You might also like to view...

Why do some people tip generously at restaurants to which they never plan to return?

What will be an ideal response?

The practice of tenure at American universities is quite common

When a junior professor is approved for tenure he or she is promoted to associate or full professor and enjoys for all intents and purposes lifetime employment and protection against firing in the event that he or she's views are at odds with the university administration. While this policy has been in place for many decades across the country why is it that universities are hesitant to grant and do so only after careful evaluation of the candidate's work even though the salary they may have to contract is lower than what one might receive in the private sector.

At a level of real disposable income of 0, consumption is $4000. Then

A) saving equals 0. B) saving equals -$4000. C) savings equal -$4000. D) saving equals $4000.

Cost-benefit principles can be applied to the decision of:

a. profit-maximizing firms. b. majority-rule voting. c. which project receives the most votes. d. rational ignorance. e. all of these.