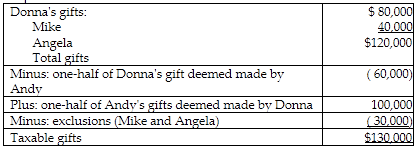

In the current year, Donna gives $50,000 cash and $30,000 of stock to Mike. She also gives $40,000 of tax-exempt bonds to Angela. Her husband, Andy, gives $200,000 of land to Angela. Assume the couple elects gift splitting for the current year. Donna's taxable gifts total

A) $130,000.

B) $148,000.

C) $110,000.

D) $60,000.

A) $130,000.

You might also like to view...

The ______ component of an attitude consists of the beliefs and knowledge one has about a situation.

A. behavioral B. decisional C. perceptual D. affective E. cognitive

Researchers who are interested in the structure of interactions typically conduct ______.

A. content analysis B. interaction analysis C. rhetorical criticism D. textual analysis

Which sequence of the mitotic stages is correct?

A. anaphase, prometaphase, metaphase, prophase, telophase B. prophase, prometaphase, metaphase, anaphase, telophase C. prophase, telophase, anaphase, prometaphase, metaphase D. telophase, anaphase, prophase, prometaphase, metaphase E. prophase, anaphase, prometaphase, metaphase, telophase

Which filing status reaches the 37% marginal rate at the lowest level of taxable income?

A. surviving spouse B. married filing separately C. married filing jointly D. head of household