Consider the following (hypothetical) cash economy with no banks. The money supply consists entirely of $1000 in currency. Output is currently at potential. The government is currently faced with a $100 budget deficit and chooses not to raise taxes, but instead prints $100 more currency with which to balance its budget. The long run result is likely to be

a) an interest rate of 10%

b) an inflation rate of 10%

c) a 10% increase in the velocity of money

d) a 10% growth rate of real GDP

e) a 10% increase in the national debt

b) an inflation rate of 10%

You might also like to view...

The marginal social cost of producing the last unit of a good is $1.10 while the consumers' willingness to pay for the last unit is $0.80. The deadweight loss from the production of the last unit of the good in equilibrium is ________

A) $1.10 B) $1.90 C) $0.50 D) $0.30

If the required reserve ratio (RR) is 20 percent, the simple deposit multiplier is

A) 2. B) 5. C) 10. D) 20.

In the last three decades, inflation has been relatively low in the U.S. economy, with the Consumer Price Index typically rising what percentage per year?

a. 1% to 2% b. 2% to 3% c. 2% to 4% d. 3% to 4 %

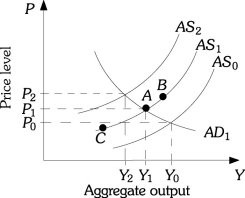

Refer to the information provided in Figure 27.3 below to answer the question(s) that follow. Figure 27.3Refer to Figure 27.3. Assume the economy is at Point A. Higher oil prices shift the aggregate supply curve to AS2. If the government decides to counter the effects of higher oil prices by increasing government spending, then the price level will be ________ than P2 and output will be ________ than Y2.

Figure 27.3Refer to Figure 27.3. Assume the economy is at Point A. Higher oil prices shift the aggregate supply curve to AS2. If the government decides to counter the effects of higher oil prices by increasing government spending, then the price level will be ________ than P2 and output will be ________ than Y2.

A. greater; less B. greater; greater C. less; less D. less; greater