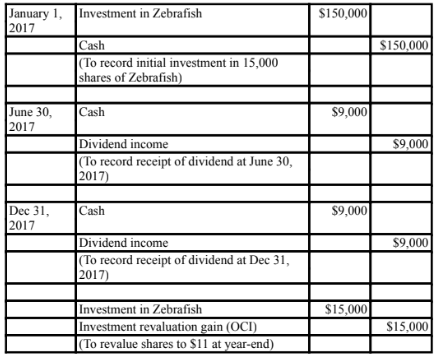

Prepare dated journal entries for Ocean Enterprises for 2017 to account for its investment in Zebrafish and any related income therefrom.

Ocean Enterprises Inc. acquired 15% of the 100,000 outstanding common shares

of Zebrafish Ltd. on January 1, 2017 for a cash consideration of $150,000 and a

further 10% of the company's common shares a year later for $110,000. On July

1, 2018, Ocean Enterprises sold half their holding in Zebrafish for proceeds of

$150,000.

Zebrafish earned income of $150,000 in 2017 and $180,000 in 2018 (evenly over

both years) and paid a regular semi-annual dividend of $60,000 in June and

December each year.

Ocean Enterprises does not have significant influence over Zebrafish and elected

when it first acquired its initial investment in Zebrafish to account for this

investment through other comprehensive income. The company's shares were

trading for $11 at the end of 2017 and $12.50 at the end of 2018.

You might also like to view...

Fast selling inventory is less likely to ________.

A) become worthless B) require higher storage costs C) require higher insurance costs D) All statements are correct.

A company's merchandise inventory includes all of the following, except

A) goods in possession, but which cannot be sold. B) goods on shelves. C) damaged goods that can be sold at a reduced price. D) goods in storerooms.

The ________, a United States regulatory agency, regulates telephone, radio, and television. This affects all firms that use broadcast media

A) Consumer Product Safety Commission B) Environmental Protection Agency C) Federal Communications Commission D) Federal Trade Commission E) Interstate Commerce Commission

Pick one of the BRICs countries (Brazil, Russia, India, China) and analyze its political structure (collective vs. individual and democratic vs. totalitarian) compared with your home country. What is the greatest difference that exists? What is your assessment of the political risk to a business entering that country?

What will be an ideal response?