According to the efficient markets theory of stock prices, some investors outperform the market because

a. they are especially skilled at analyzing stock price trends

b. in any large group of investors, there will probably be some unusually lucky ones

c. they are most likely the beneficiaries of insider trading

d. they have better information about firms' technologies and production costs

e. they have a superior ability to predict consumer behavior

B

You might also like to view...

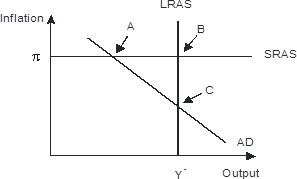

Refer to the figure below. In response to gradually falling inflation, this economy will eventually move from its short-run equilibrium to its long-run equilibrium. Graphically, this would be seen as

A. long-run aggregate supply shifting leftward B. Short-run aggregate supply shifting downward C. Aggregate demand shifting rightward D. Aggregate demand shifting leftward

If a used-car dealer enjoys economic profits, then

A) as a group, its customers necessarily suffered a like amount in economic losses. B) as a group, its customers were necessarily made worse off. C) as a group, its competitors necessarily suffered economic losses. D) all of the above are true. E) none of the above is true.

The top policy goal for Paul Volcker when he became chairman of the Federal Reserve's Board of Governors in 1979 was

A) fighting inflation. B) increasing employment. C) increasing economic growth. D) increasing regulation of commercial banks. E) a low current account deficit.

When the money supply rises by 10%, in the short run, output ________ and the price level ________.

A. rises; is unchanged B. declines; falls C. declines; is unchanged D. is unchanged; falls