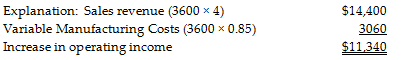

Inscribe, Inc. manufactures and sells pens for $7 each. Cubby Corp. has offered Inscribe, Inc. $4 per pen for a one-time order of 3600 pens. The total manufacturing cost per pen, using absorption costing, is $1 per unit and consists of variable costs of $0.85 per pen and fixed overhead costs of $0.15 per pen. Assume that Inscribe, Inc. has excess capacity and that the special pricing order would not adversely affect regular sales. What is the change in operating income that would result from accepting the special pricing order?

A) increase of $10,800

B) decrease of $10,800

C) increase of $11,340

D) decrease of $11,340

C) increase of $11,340

You might also like to view...

If 1 euro is equal to 1.20 dollars, ?

A. ?$1 would trade for 0.83 euros. B. ?$1 would trade for 2.20 euros. C. ?$1 would trade for 0.20 euros D. $1 would trade for 0.33 euros.

A consignment is treated as a sale or return contract under the UCC

Indicate whether the statement is true or false

A sentence that consists of one independent clause that cannot stand alone as a complete thought is a simple sentence

Indicate whether the statement is true or false

An amendment to the Constitution may be approved to become effective by:

a. a majority of state supreme courts to become effective b. passing 3/4 of the state legislatures after passing by a 2/3 vote in the Senate and House c. passing 2/3 of the state legislatures after passing by majority vote in the Senate and House d. the President and 2/3 of the Senate e. none of the other choices