Suppose that a price-taking firm charges $12 for its product and has a cost function given by C(Q) = 2Q + (Q2/60). The corresponding marginal cost is given by MC(Q) = 2 + (Q/30). How much output should the firm produce? What if the firm has $2,000 of avoidable fixed costs?

What will be an ideal response?

A price-taking firm will produce the level of output for which P = MC. For this firm, 12 = 2 + (Q/30) implies that Q = 300. The profit associated with 300 units of output is given by ? = (12 × 300) - (2 × 300) + (3002/60) = 4,500. Since the firm has no sunk fixed costs, the profit from shutting down would be zero. Therefore, the firm should produce 300 units of output.

You might also like to view...

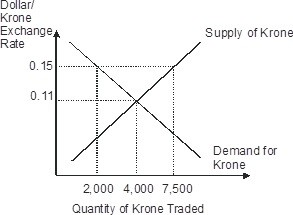

Based on this figure, if the official fixed value of krone is fixed at $0.15 per krone, then the Norwegian krone is ________ and the international reserves of Norway will ________ krone per period.

A. undervalued; increase by 2,000 B. undervalued; increase by 5,500 C. overvalued; decrease by 2,000 D. overvalued; decrease by 5,500

Price cap regulation

A) does not provide incentives to firms to minimize their costs because firms cannot change prices. B) sets the maximum price these firms can charge. C) gives firms the incentive to exaggerate their costs. D) Both answers A and C are correct. E) Both answers A and B are correct.

The opportunity costs of labor is largely determined by

A) demand. B) supply. C) need. D) greed.

In his article, "The Nature of the Firm," Ronald Coase

a. suggested that monopolies may be more innovative than competitive firms b. argued that the economy should be organized into one large firm c. provided an answer to the question, "Why do firms exist?" d. focused on the concept of adverse selection e. analyzed concentration in U.S. industry