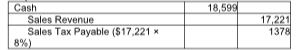

Venus Corp. sold goods, with a selling price of $17,221, for cash. The state sales tax rate is 8%. What amount is credited to the Sales Revenue account? (Round calculations to the nearest dollar.)

A) $17,221

B) $18,599

C) $1378

D) $15,843

A) $17,221

Business

You might also like to view...

A stock's price is $20 at the beginning of a year. There is a 25 percent chance that the price will be $17 at the end of the year, and a 75 percent chance that the price will be $25 at the end of the year. The stock will pay a dividend of $3 during the year. The expected return on the stock is ____ percent.

A. 10 B. 20 C. 30 D. 40

Business

In a deferred payment arrangement, interest is charged only if it is stated

Indicate whether the statement is true or false

Business

Nonverbal messages can be dismissed since they do not contribute to verbal messages

Indicate whether the statement is true or false

Business

An emergency reserve is held for transactions purposes

Indicate whether the statement is true or false.

Business