Which of the following is NOT an example of moral hazard in business?

A) A bank buys risky mortgage securities because they believe the government will provide a bail-out if the investment performs badly.

B) A firm uses venture capital to speculate in the commodity futures market.

C) A firm does not hire adequate security protection for its warehouse after it pays for insurance on the property.

D) Firms with the large debt problems are more likely to apply for bank loans than financially stable firms.

D

You might also like to view...

Yasukichi Yasuba's research suggests that the decline in the U.S. fertility rate in the antebellum period was due to

a. rising land prices. b. people marrying later in life. c. rising manufacturing wages. d. a high percentage of young males and a low percentage of young females in the population.

The salary of the president of the United States in 2000 was $400,000. In 1940, the president's salary was $75,000. If the Consumer Price Index was 8.1 in 1940 and 100 in 2000, the 1940 presidential salary measured in terms of the purchasing power of the dollar in 2000 would be:

A. less than $75,000. B. less than $400,000. C. approximately $668,850. D. approximately $926,000.

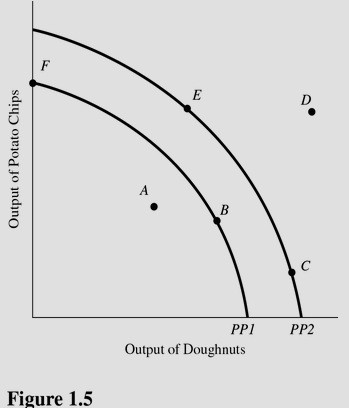

In Figure 1.5, at which of the following points would the opportunity cost of producing more doughnuts be greatest?

In Figure 1.5, at which of the following points would the opportunity cost of producing more doughnuts be greatest?

A. A. B. C. C. E. D. F.

A major difference between a monopolist and a perfectly competitive firm is that

A) the monopolist is certain to earn economic profits. B) the monopolist's marginal revenue curve lies below its demand curve. C) the monopolist engages in marginal cost pricing. D) the monopolist charges the highest possible price that he can.