Assume that the central bank increases the reserve requirement. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to real GDP and net nonreserve-related international borrowing/lending in the context of the Three-Sector-Model?

a. Real GDP falls, and net nonreserve-related international borrowing/lending becomes more negative (or less positive).

b. Real GDP rises, and net nonreserve-related international borrowing/lending becomes more negative (or less positive).

c. Real GDP falls, and net nonreserve-related international borrowing/lending becomes more positive (or less negative).

d. Real GDP and net nonreserve-related international borrowing/lending remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.C

You might also like to view...

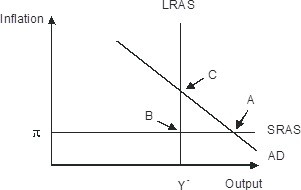

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

The threat of a strike

a. can serve as an incentive for labor and management to reach an agreement b. destroys incentives for labor and management to reach an agreement c. is usually not taken seriously because employers know the workers will suffer during a strike d. is not taken seriously unless management expects to suffer e. is not taken seriously if public safety is at risk

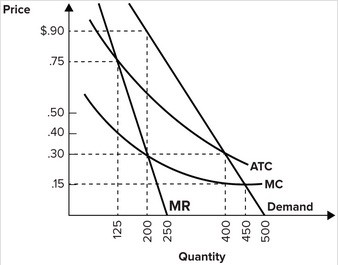

Refer to the graph shown. If this monopolist were forced to set price equal to average total cost, it would charge a price of:

A. $0.90. B. $0.30. C. $0.75. D. $0.15.

If there is an unrest in Europe that threatens the economic stability of Turkey, the

A. supply of the Turkish currency will fall. B. demand for the Turkish currency will fall. C. demand for the Turkish currency will rise. D. supply of the Turkish currency will rise.