Consider the budget constraint between "spending today" on the horizontal axis and "spending a year from today" on the vertical axis. Suppose that you have $100 today and expect to receive $100 one year from today. Your money market account pays an annual interest rate of 25%, and you may borrow money at that interest rate. Suppose now that the interest rate increases to 40%. What happens to the

slope of your budget constraint relative to when the interest rate was 25%? The slope

a. becomes steeper.

b. becomes flatter.

c. doesn't change because the budget constraint shifts in parallel to the original budget constraint.

d. doesn't change because the budget constraint shifts out parallel to the original budget constraint.

a

You might also like to view...

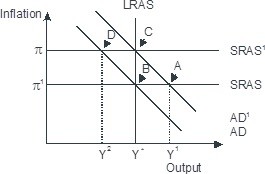

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

Newly issued stocks and bonds are bought and sold in

A) primary markets. B) auction markets. C) futures markets. D) commodity markets.

If all information is reflected in current prices, the market is

A) resilient. B) deep. C) primary. D) efficient.

The quantity of U.S. dollars demanded in foreign exchange markets is primarily a function of ________

A) the demand for U.S. goods and services B) the demand for U.S. goods by foreigners C) the expected return on U.S. dollar assets relative to foreign assets D) foreign interest rates