A fire destroys David's business building that cost $200,000 in 2005 and had an adjusted basis of $160,000. David's insurance company reimburses him $250,000 for his loss. David promptly reconstructs the building for $230,000.

a.What is the amount and the character of David's minimum recognized gain (loss)?b.What is the basis of David's new building?

What will be an ideal response?

| a. | David must recognize an unrecaptured Section 1250 gain of $20,000 on the casualty. David realizes a gain of $90,000 ($250,000 - $160,000). David is allowed to defer the casualty gain. However, any insurance proceeds that are not reinvested in the replacement property are subject to tax. In this case, David has $20,000 ($250,000 - $230,000) of insurance proceeds remaining after the replacement. Buildings used in a trade or business are Section 1231 property. David does not have to recapture any depreciation on the gain because the property is Section 1250 property and straight-line depreciation would have been used on the property (39-year MACRS property). However, the portion of the gain that is attributable to the depreciation taken on the building is considered unrecaptured Section 1250 gain and is taxed at a maximum tax rate of 25%. |

| b. | David's basis in the new building is $160,000 ($230,000 - $70,000). Any gain realized on a casualty that is not recognized in the current period is deferred to the basis of the replacement property. |

You might also like to view...

Which of the following is an example of the type of analytics that an auditor would use for inventory?

a. Number of day's sales in receivables compared to industry averages. b. Inventory turnover for the previous five years. c. Days outstanding in accounts payable. d. Salaries of marketing personnel as a percent of total inventory.

A machine that is programmed to package 1.20 pounds of cereal is being tested for its accuracy in a sample of 36 cereal boxes, the sample mean filling weight is calculated as 1.22 pounds. The population standard deviation is known to be 0.06 pounds. Which of the following conclusions is correct?

A. There is not enough information to make a conclusion. B. The machine is operating properly because the interval contains the target. C. The machine is operating improperly because the target is above the upper limit. D. The machine is operating improperly because the target is below the lower limit.

In the context of the skills of successful managers, being considerate when tasks are difficult and helping employees overcome anxiety and stress is part of the ________ set of skills.

A. consulting B. empowering C. developing D. supporting

Ignoring taxes, what is the total amount of pre-tax profit from 2017 sales that was realized during 2017?

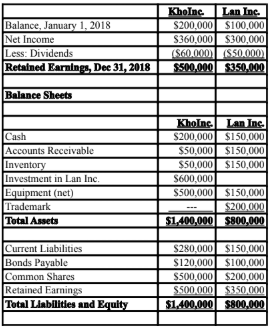

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2017. On that date, Lan's commons shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc.

Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2027. Both companies use straight line amortization exclusively.

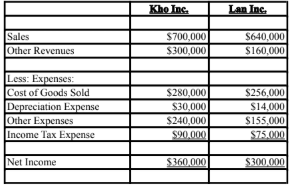

The financial statements of both companies for the year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2018 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2017, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year.

During 2018, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2017, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year.

During 2018, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 20%.

A) Nil. B) $5,000. C) $6,200. D) $9,800.