Consider that Britain is trying to maintain a fixed exchange rate with respect to the U.S. dollar. However, the present situation in the foreign exchange market is conducive for the British pound to depreciate with respect to the U.S. dollar. A fully sterilized intervention in the foreign exchange market by the British government is expected to cause

A. Britain to gain official international reserves.

B. the British money supply to fall.

C. the British money supply to remain unchanged.

D. the British money supply to rise.

Answer: C

You might also like to view...

In an economy where aggregate spending is given by Y = 5,500 + 0.6Y - 20,000r, the interest rate is currently 5 percent (0.05). If potential output equals 11,750, the central bank must ________ the interest rate to close the ________ gap.

A. raise; recessionary B. reduce; recessionary C. raise; expansionary D. reduce; expansionary

A point outside a production possibilities curve reflects:

a. efficiency. b. specialization. c. inefficiency. d. unemployment. e. an impossible choice.

If GDP is $1,000 . consumption is $750, interest payments are $200, rent payments are $400, and profits are $200, what must wages and salaries equal?

a. $800 b. $400 c. $250 d. $0 e. $200

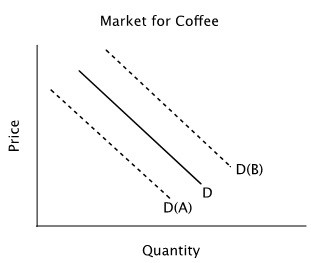

Refer to the accompanying figure. Suppose the solid line shows the demand for coffee. If coffee and tea are substitutes, and the price of tea falls, then you would expect:

A. the demand curve to shift to D(B) B. the demand curve to shift to D(A). C. a decrease in the quantity of coffee demanded, but no shift in the demand curve. D. an increase in the quantity of coffee demanded, but no shift in the demand curve.