You are considering the following bonds to include in your portfolio:

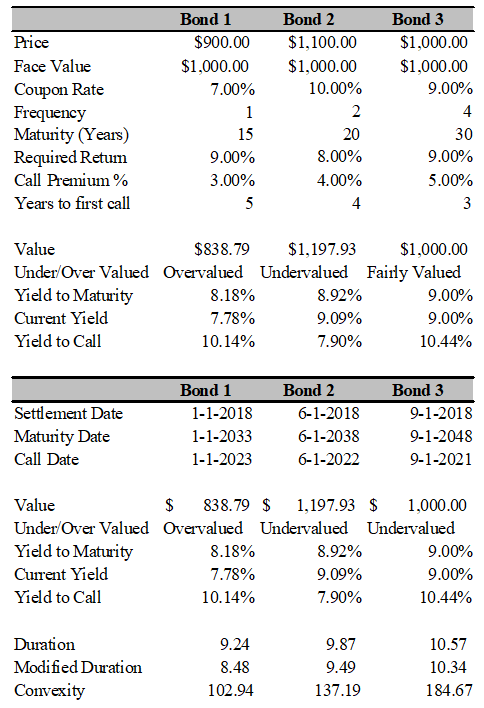

a) Determine the highest price you would be willing to pay for each of these bonds using the PV function. Also find whether the bond is undervalued, overvalued, or fairly valued.

b) Determine the yield to maturity on these bonds using the Rate function assuming that you purchase them at the given price. Also calculate the current yield of each bond.

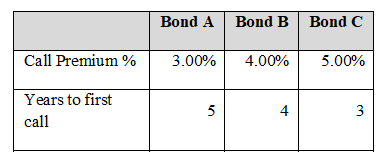

c) Determine the yield to call of each bond using the Rate function if the time to first call and the call premium are the following:

d) Assume the following settlement dates for each bond:

Use the Price and Yield functions to recalculate your answers on parts (a), (b), and (c).

e) Determine the duration, the modified duration, and the convexity of each bond.

You might also like to view...

In human resource forecasting, ______ identifies the estimated supply and demand for the different types of human resources in the organization over some future period, based on analysis of past and present demand.

A. HR analysis B. qualitative forecast C. regression analysis D. ratio analysis

Why did Congress enact the at-risk rules?

What will be an ideal response?

The executive summary of a financial statement analysis report includes the evidential matter, assumptions, and inferences for the report.

Answer the following statement true (T) or false (F)

. According to Schein, organizational culture is ______.

A. artifacts B. espouse beliefs and values C. basic underlying assumptions D. all of these