The interest rate that the Fed charges banks for loans to them through the traditional channel is called:

A. The discount rate

B. Interest on reserves

C. The federal funds rate

D. The prime rate

A. The discount rate

You might also like to view...

Which of the following is NOT a factor that has contributed to declining private-sector differential between union and nonunion wages in the U.S. since 1980?

A) Globalization of the production process B) Improved ability of firms to substitute capital for labor in production C) Adoption of two-tiered wage and benefit structures by unionized firms D) Declines in the unemployment and health insurance premiums paid by union workers

A $1 million increase in investment spending will raise equilibrium output (real GDP) by:

a. less than $1 million. b. exactly $1 million. c. between $0.5 and $1.5 million. d. more than $1 million.

When the required reserve ratio is lowered,

a. the money multiplier increases, and the amount of excess reserves increases in the banking system. b. the money multiplier decreases, and the amount of excess reserves increases in the banking system. c. the money multiplier decreases, and the amount of excess reserves decreases in the banking system. d. the money multiplier increases, and the amount of excess reserves decreases in the banking system. e. there is no change in either the money multiplier or the amount of excess reserves in the banking system.

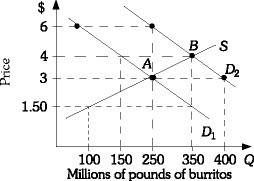

Refer to the information provided in Figure 3.18 below to answer the question(s) that follow. Figure 3.18Refer to Figure 3.18 The market is initially in equilibrium at Point B. If demand shifts from D2 to D1 and the price of burritos remains constant at $4.00, there will be

Figure 3.18Refer to Figure 3.18 The market is initially in equilibrium at Point B. If demand shifts from D2 to D1 and the price of burritos remains constant at $4.00, there will be

A. an excess supply of 200 million pounds of burritos. B. an excess demand of 200 million pounds of burritos. C. an excess demand of 100 million pounds of burritos. D. an excess supply of 100 million pounds of burritos.