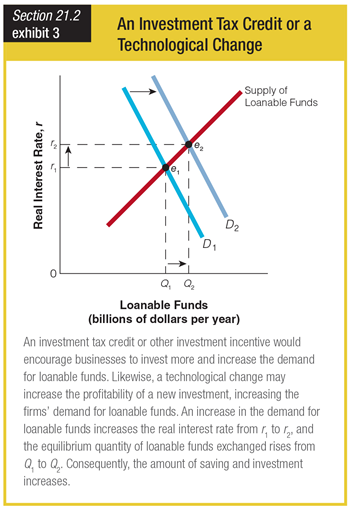

Based on the graph showing the effects of an investment tax credit or a technological change, eliminating an investment tax credit would ______.

a. increase the demand curve for loanable funds

b. decrease the demand curve for loanable funds

c. increase the supply curve for loanable funds

d. decrease the supply curve for loanable funds

b. decrease the demand curve for loanable funds

You might also like to view...

From the economist's point of view, dividends paid to stockholders are part of a corporation's costs

A) because taxes are paid on a corporation's profits prior to the payment of dividends. B) because they must be included in stockholders' incomes for purposes of personal income taxation. C) insofar as they are contractual obligations. D) insofar as they represent what funds invested in the corporation could have earned elsewhere.

The hypothesis stating that people combine the effects of past policy changes on important economic variables with their own judgment about the future effects of future and current policy changes is known as

A) policy irrelevance hypothesis. B) rational expectations hypothesis. C) life cycle hypothesis. D) real business cycle hypothesis.

Which of the following will not increase when net taxes decrease?

a. Saving b. Disposable income c. Consumption d. Government expenditure e. GDP

Under which of the following conditions could the monopoly price be less than the price that would result in perfect competition? When there are

a. diminishing marginal returns b. substantial economies of scale c. higher unit costs d. increasing costs e. constant returns to scale