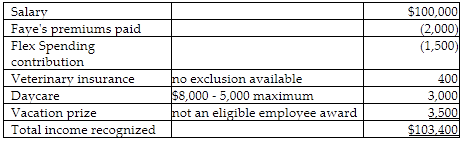

How much income must Faye recognize from her employment?

Faye is a marketing manager for Healthy Corp. She earns a salary of $100,000 and has received the following benefits:

• Healthy pays 75% of all employees' health and accident insurance coverage. Healthy paid $6,000 towards the cost of Faye's health insurance during the year.

• Faye participates in the cafeteria plan and had elected to have $2,000 withheld from her pay to cover the remaining cost of the health insurance premiums and an additional $1,500 to cover dental and other health care costs not paid by insurance (i.e., funding a flexible spending account). The full $1,500 was used to pay for various qualifying medical costs.

• Healthy pays the cost of disability insurance coverage for all employees. The insurance will pay 75% of salary if employees are out of work for a significant period. The cost of Faye's premiums was $600.

• Healthy pays for the cost of veterinary insurance for all employees. The cost of coverage for Faye's dog was $400.

• Healthy pays for the cost of daycare for its employees' children. The cost for Faye's two children was $8,000.

• All employees receive a 20% discount on Healthy's products. The typical markup on their products is 25%. Faye enjoyed $1,200 of savings through the discount program.

• Faye won the manager of the year award earlier in the year and received an all-expense paid week at a desert spa valued at $3,500.

• Healthy pays Faye's annual membership dues of $500 to the American Marketing Association.

• Healthy paid for the full $2,500 cost of Faye's attendance at the American Marketing Association's annual conference in Orlando.

The company-paid premiums for the health insurance and the disability insurance can be excluded. The value of the qualified employee discount can be excluded. The company payments of the professional dues and attendance at the marketing conference are excluded under the working condition fringe.

You might also like to view...

The measures of location are also known as measures of central tendency because they tend to describe the center of the distribution

Indicate whether the statement is true or false

Alton Van Lines is considering the acquisition of two new trucks. Because of improved mileage, these vehicles are expected to have a lower operating cost per mile than the trucks the company plans to replace. Management is studying whether the firm would be better-off keeping the older vehicles or going ahead with the replacement, and has identified the following decision factors to evaluate: 1. Cost and book value of the old trucks2. Moving revenues, which are not expected to change with the acquisition3. Operating costs of the new and old vehicles4. New truck purchase price and related depreciation charges5. Proceeds from sale of the old vehicles6. The 8% return on alternative investments that Alton will forego by tying up cash in the new trucks7. Drivers' wages and fringe

benefitsRequired: Classify the seven decision factors listed into the following categories (note: A factor may be included in more than one category, or the factor may not necessarily be included in any of the categories):A. Relevant information.B. Opportunity costs.C. Sunk costs.D. Factors to be considered in the decision. What will be an ideal response?

On August 1 of the current year, Terry refinances her home and borrows $240,000. Terry is required to pay two points on the loan. The loan is secured by the residence and the charging of points is an established business practice in the area. The term of the loan is 20 years, beginning on August 1 of the current year. How much, if any, of the points may Terry deduct in the current year?

A. $4,800 B. $240 C. $0 D. $100

Give a real-world application of co-branding

What will be an ideal response?