A U.S. automobile dealer has ordered a fleet of Japanese cars worth 10 million yen. The terms of payment is C.O.D. (cash on delivery). At the time the order was placed, the exchange rate was 100 yen per U.S. dollar. When the fleet arrived the exchange

rate had become 200 yen per U.S. dollar.

A) This change in the foreign exchange rate will hurt the U.S. importer.

B) This change in the foreign exchange rate will hurt the Japanese exporter.

C) This change in the foreign exchange rate will benefit the U.S. importer.

D) This change in the foreign exchange rate will benefit the Japanese exporter.

Answer: C

You might also like to view...

Refer to Figure 19-10. Under the Bretton Woods System of exchange rates, if the par exchange rate was $2 per pound in the figure above, and equilibrium persisted at $3, then a revaluation of the currency would have

A) led to a balance of trade surplus. B) increased the price of imports to Britain. C) led to a current account surplus. D) increased the price of British exports to the United States.

A patent issued by the government, gives a firm monopoly power on certain products or discoveries

a. True b. False Indicate whether the statement is true or false

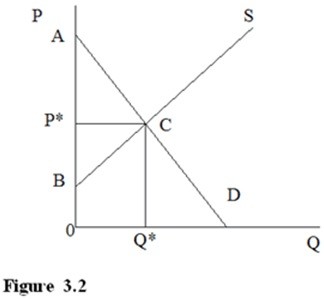

In Figure 3.2, what is the producer surplus?

A. 0ACQ* B. 0PCQ* C. BP*C D. P*AC

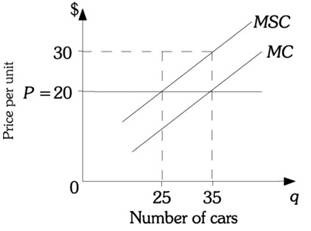

Refer to the information provided in Figure 16.2 below to answer the question(s) that follow. Figure 16.2Refer to Figure 16.2. What is the total damage imposed as a result of producing the market (unregulated) level of cars?

Figure 16.2Refer to Figure 16.2. What is the total damage imposed as a result of producing the market (unregulated) level of cars?

A. $250 B. $350 C. $500 D. $700