Boe Corporation is investigating buying a small used aircraft for the use of its executives. The aircraft would have a useful life of 9 years. The company uses a discount rate of 10% in its capital budgeting. The net present value of the investment, excluding the salvage value of the aircraft, is ?$439,527. Management is having difficulty estimating the salvage value of the aircraft. To the nearest whole dollar how large would the salvage value of the aircraft have to be to make the investment in the aircraft financially attractive?Refer to Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided.

A. $439,527

B. $1,036,620

C. $43,953

D. $4,395,270

Answer: B

You might also like to view...

________ involves enhancing the value of a market offering for a limited time

A) Direct marketing B) Viral marketing C) Advertising D) Sales promotion E) Publicity

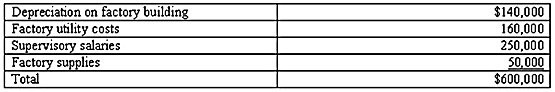

Parr Corporation makes three products, X, Y, and Z. Expected overhead costs for the coming year include: Parr uses direct labor hours as the cost driver to allocate overhead costs. Budgeted direct labor hours for each product are:Product X, 15,000 direct labor hoursProduct Y, 10,000 direct labor hoursProduct Z, 5,000 direct labor hoursRequired:1) Determine the amount of manufacturing overhead that should be allocated to each of the three products.2) Assume that each unit of Product X requires $40 in direct materials and 3 direct labor hours at a rate of $15 per hour. Calculate the budgeted or expected cost of each unit of X.

Parr uses direct labor hours as the cost driver to allocate overhead costs. Budgeted direct labor hours for each product are:Product X, 15,000 direct labor hoursProduct Y, 10,000 direct labor hoursProduct Z, 5,000 direct labor hoursRequired:1) Determine the amount of manufacturing overhead that should be allocated to each of the three products.2) Assume that each unit of Product X requires $40 in direct materials and 3 direct labor hours at a rate of $15 per hour. Calculate the budgeted or expected cost of each unit of X.

What will be an ideal response?

Flask Company reports net sales of $4,315 million; cost of goods sold of $2,808 million; net income of $283 million; and average total assets of $2,136. Compute its total asset turnover.

A. .13 B. .50 C. 1.31 D. .76 E. 2.02

What are three acceptable test validation strategies?

What will be an ideal response?