Assume that business investment spending rises, and the increase is funded by greater borrowing in the capital markets. If the nation has low mobility international capital markets and a fixed exchange rate system, what happens to the quantity of real loanable funds per time period and reserve-related (central bank) transactions in the context of the Three-Sector-Model?

a. The quantity of real loanable funds per time period rises and reserve-related (central bank) transactions become more positive (or less negative).

b. The quantity of real loanable funds per time period falls and reserve-related (central bank) transactions remain the same.

c. The quantity of real loanable funds per time period and reserve-related (central bank) transactions remain the same.

d. The quantity of real loanable funds per time period rises and reserve-related (central bank) transactions remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.A

You might also like to view...

Countries such as the United States that have large populations tend to have

A) higher trade-to-GDP ratios. B) lower trade-to-GDP ratios. C) relatively greater capital outflows. D) relatively smaller capital outflows. E) None of the above.

Government corruption reduces economic growth around the globe, most commonly through widespread cash payments or gifts to receive a government service

Indicate whether the statement is true or false

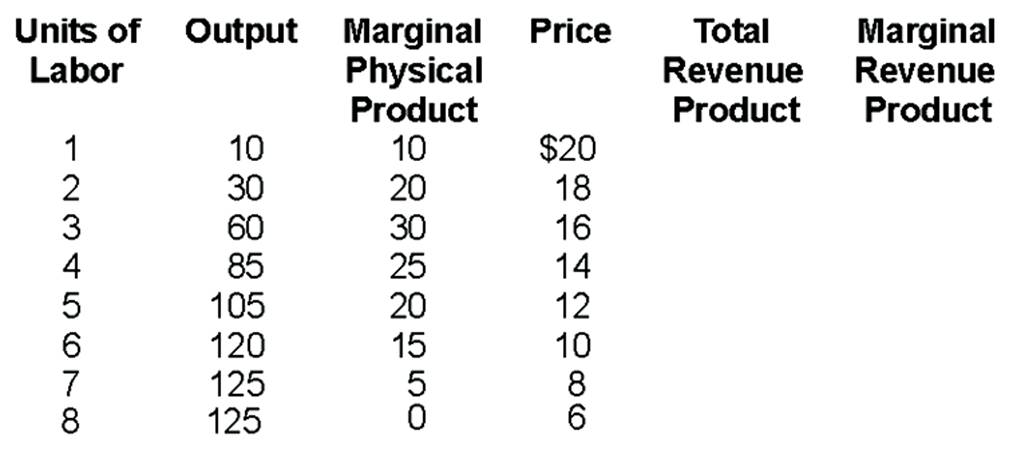

If the wage rate were $50, how many workers would be hired?

A. 1

B. 2

C. 3

D. 5

If the total cost of producing 10 jets is $28 million and the total cost of producing 11 jets is $30 million, this firm is experiencing

A. economies of scale in the range of 10 to 11 jets. B. constant returns to scale in the range of 10 to 11 jets. C. diseconomies of scale in the range of 10 to 11 jets. D. increasing average variable costs in the range of 10 to 11 jets.