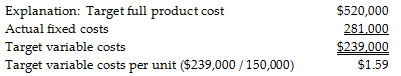

Actual costs are currently higher than target full product cost. Assuming that fixed costs cannot be reduced, what is the target variable cost per unit? (Round your answer to the nearest cent.)

Well-Bread Grain Company is a price-taker and uses target pricing. The company has just done an analysis of its revenues, costs, and desired profits and has calculated its target full product cost. Assume all products produced are sold. Refer to the following information:

A) $3.47

B) $1.59

C) $1.87

D) $2.00

B) $1.59

You might also like to view...

The internal audit department recalculates payroll for several employees each pay period. This is an example of __________________________

Fill in the blank(s) with correct word

Greyzone, a company that creates customized household furniture, is based in Terrania and is looking to enter other countries as well

The company identifies the country of Nyevka as a good option because the entry barriers for new companies are low in Nyevka. Which statement indicates that Greyzone follows a diversification strategy? A) Greyzone does not modify its products for the Nyevkan market. B) Greyzone leaves the Terranian market entirely in order to establish itself in the Nyevkan market with its current products. C) Noting that Nyevka lacks well-established suppliers of office equipment, Greyzone begins to manufacture and supply office equipment. D) Greyzone manufactures furniture in Terrania and ships it to Nyevka without setting up outlets in Nyevka. E) Noting that production costs are lower in Nyevka, Greyzone shifts its production operations entirely to Nyevka.

A value-adding activity is one that increases the cost of a product but does not add to the product's market value

Indicate whether the statement is true or false

Which of the following is a provision of SFAS No. 131?

a. Segment liabilities must be reported, but reported segment assets is optional. b. Reconciliation of segment profit or loss to consolidated profit of loss must be done before income taxes. c. A segment is constituted by having 20% or more of combined revenue of all operating segments. d. Segment reporting is based on the way management organizes the segments for making operating decisions and assessing performance.