Susan took out a life insurance policy on herself, paying all of the premium payments. She named her daughter, Jessica, as the beneficiary under the policy. Jessica has not given anything in consideration for the policy. Jessica is:

a. a donee beneficiary who has rights to enforce the policy once Susan dies.

b. a creditor beneficiary who has rights to enforce the policy once Susan dies.

c. an incidental beneficiary because Jessica did not give any consideration for the policy and therefore cannot enforce the policy even when Susan dies.

d. None of the above.

a

You might also like to view...

According to Jean Piaget, what does a child possess at 18 months that he or she does not at 14 months?

a. feelings such as pride and shame b. curiosity c. a social smile d. an understanding of what it means to be good or bad

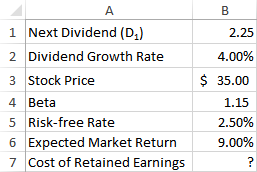

What is the correct formula for B7 to find the cost of retained earnings using the constant growth dividend discount model?

a) =B5+B4*B6

b) =B1/B3+B2

c) =B3/B1+B2

d) =B4*B6+B2

e) =B5+B4*(B6-B5)

A broad statement that defines the purpose for a company's existence, including its business, objectives, and approach for reaching those objectives is known as a ________ statement.

Fill in the blank(s) with the appropriate word(s).

A law firm would use a job order cost system to accumulate all of the costs associated with a particular client engagement, such as lawyer time, copying charges, filing fees, and overhead

Indicate whether the statement is true or false