The growth in per share FCFE of CBS, Inc. is expected to be 10% per year for the next two years, followed by a growth rate of 5% per year for three years. After this five-year period, the growth in per share FCFE is expected to be 2% per year, indefinitely. The required rate of return on CBS, Inc. is 12%. Last year's per share FCFE was $2.00. What should the stock sell for today?

A. $8.99

B. $22.51

C. $40.00

D. $25.21

E. $27.12

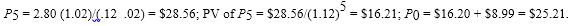

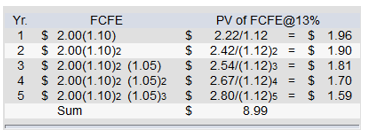

D. $25.21

Calculations are shown below.

You might also like to view...

In order to analyze the competitiveness of the banks affected by mergers, the Fed found out that in _____ out of the 49 banking markets, in which both Wells Fargo and Wachovia had operations, the merger will not violate any guidelines based on HHI or other guidelines.

A. 32 B. 40 C. 48 D. 37

Annual reports ________.

A) are required to be prepared by every corporation B) discuss the company's competitors and the risks related to the company's business C) are also called a Form 10-Q D) only include the company's financial statements

Well-trained salespeople can add value to the traditional retail shopping experience. Selling for a retailer might involve which of the following products?

A) personal computers, automobiles and assembly line robotics equipment B) photographic equipment, industrial specialties and recreational equipment C) fashion apparel, personal computers and recreational vehicles D) microchips, musical instruments and automobiles E) software back-end integration services, jewelry, and motorcycles

An employer can pay less than the minimum wage to take into account the reasonable cost of

meals and lodging supplied to employees. Indicate whether the statement is true or false