A company purchases a one-year insurance policy on June 1 for $1,260. The adjusting entry on December 31 is

A) debit Insurance Expense, $630 and credit Prepaid Insurance, $630.

B) debit Insurance Expense, $525 and credit Prepaid Insurance, $525.

C) debit Insurance Expense, $735, and credit Prepaid Insurance, $735.

D) debit Prepaid Insurance, $630, and credit Cash, $630.

C

You might also like to view...

Which of the following is a professional service enterprise?

a. Bookstore; b. Veterinary clinic; c. Pharmacy; d. Recording studio; e. All of these are professional service enterprises

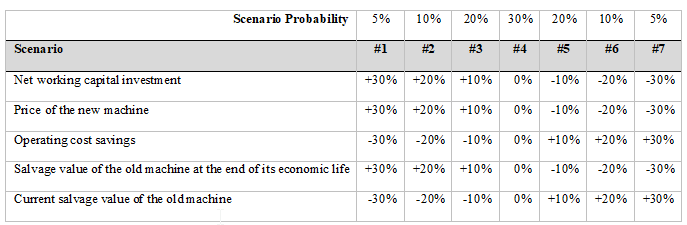

Consider the data in problem 2 and perform a scenario analysis using the percentages of change for the same uncertain variables and the probabilities for each scenario given in the following table:

a) Determine the payback period, discounted payback period, NPV, PI, IRR, and MIRR of this project under each scenario.

b) Determine the expected NPV, PI, and IRR, and the corresponding standard deviation, coefficient of variation, and the probability of a negative NPV, a PI equal to 1, and an IRR equal to the firm’s IRR.

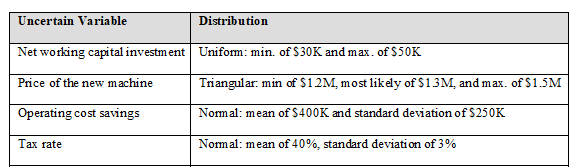

c) Perform a Monte Carlo simulation with 1,000 trials to determine the expected NPV. Also determine the standard deviation of the expected NPV. The uncertain variables and their probability distributions are given in the following table:

d) Create a histogram using the Histogram chart type, showing the probability distribution of NPV.

e) Using the output of the simulation, determine the probability that the NPV will be less than or equal to zero. Compare your results with those of part (a).

Professor Lockhart signed a contract at the State University, where he has to teach at least eight classes per year, for which he will be paid an annual salary. He now has to follow which two standards?

a. quantity and time b. behavior and time c. quality and cost d. behavior and cost

Compare the substantial continuity test in regard to successor liability with the mere continuation test. Which test is applied by the majority of states?