The interest rate in the federal funds market:

A. is determined by the imposition of price controls imposed by the Fed.

B. rises when the quantity of funds demanded by banks seeking additional reserves exceeds the quantity supplied by banks with excess reserves.

C. will fall if the Fed sells bonds and, thereby, reduces the reserves available to banks.

D. is an interest rate that is largely unaffected by the policies of the Fed.

Answer: B

You might also like to view...

Capital goods are

A. long-lived goods used for producing other goods and services. B. excluded from GDP. C. the end products of production. D. publicly provided.

The above figure shows the marginal private benefit and marginal social cost of a college education. If society's external benefits from college graduates is $10,000 each, then the private market outcome is inefficient because

A) no students will go to college. B) society places less value on educating the next student than it will cost society to educate that student. C) society places greater value on educating the next student than it will cost society to educate that student. D) the marginal cost will shift upward.

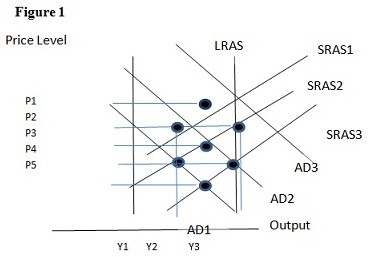

The long-run aggregate supply curve is the relationship between the price level and the quantity of real GDP that is supplied once input prices have had time to fully adjust to that price level

a. True b. False Indicate whether the statement is true or false

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.