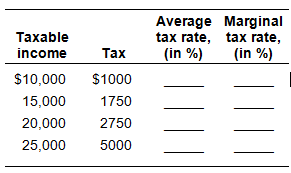

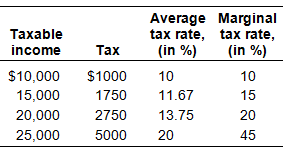

Given the following information on the tax paid for different levels of taxable income, fill in the average and the marginal tax rates for each income level. Also explain how to calculate the average tax rate and the marginal tax rate. Is this tax

progressive?

To find the average figures divide total tax by total income. To find the marginal figures divide the change in tax by the change in income. Note that the first marginal tax rate is often excluded because the difference between no income and $10,000 here will produce the same results as the average tax rate is progressive.

You might also like to view...

An American farmer today feeds over ______ people.

A. 15 B. 30 C. 50 D. 100

The existence of a shortage

A) means resources are being allocated efficiently. B) is impossible in a market economy. C) pushes the price u

_______ refers to how quickly, easily, and reliably an asset can be converted into cash.

a) Barter b) Fiat money c) Unit of account d) Liquidity

Suppose that in the economy of Idaho, Amy earns an income of $50,000 a year and pays $10,000 in income taxes; Bailey earns an income of $25,000 a year and pays $8,000 in income taxes. Based on this information, we could say that Idaho's tax system is

A. progressive. B. regressive. C. flat. D. proportional.