Outline the possible work disincentives created by anti-poverty programs. Is there a way to solve this problem without causing other forms of inefficiency to arise? Explain your answer

A high marginal tax rate exists on welfare transfers. There is inherently a trade-off between burdening the poor with a high effective marginal tax rate and burdening taxpayers with costly programs to reduce poverty.

You might also like to view...

The fact that rubies are more expensive than milk reflects the fact that for most consumers

A) the total utility from rubies exceeds that from milk. B) the marginal utility from rubies equals that from milk. C) more milk is consumed than rubies. D) a quart of rubies is considered to be prettier than a quart of milk.

Which of the following classifications is correct?

A. City streets are consumption goods because they wear out with use. B. Stocks are capital goods because when people buy and sell them they make a profit. C. The coffee maker in the coffee shop at an airport is a consumption good because people buy the coffee it produces. D. White House security is a government service because it is paid for by the government..

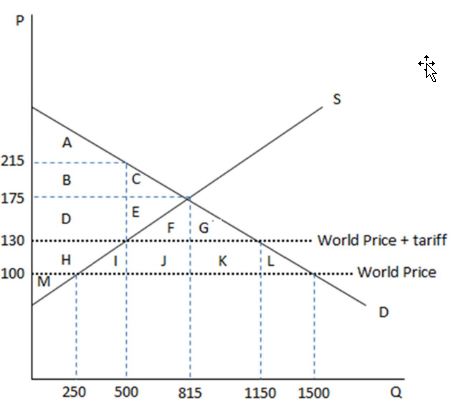

According to the graph shown, if this economy were open to free trade, and decided to impose a tariff, the domestic quantity supplied would increase from:

This graph demonstrates the domestic demand and supply for a good, as well as a tariff and the world price for that good.

A. 815 to 1500.

B. 815 to 1150.

C. 250 to 500.

D. 250 to 815.

When a market is corrected for externalities, it:

A. is efficient and maximizes surplus. B. is equitable and makes everyone better off. C. needs government regulation to maintain. D. All of these statements are true.