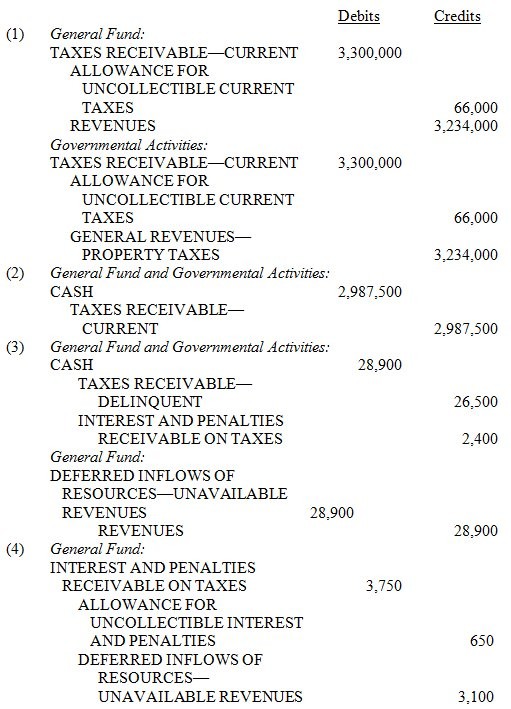

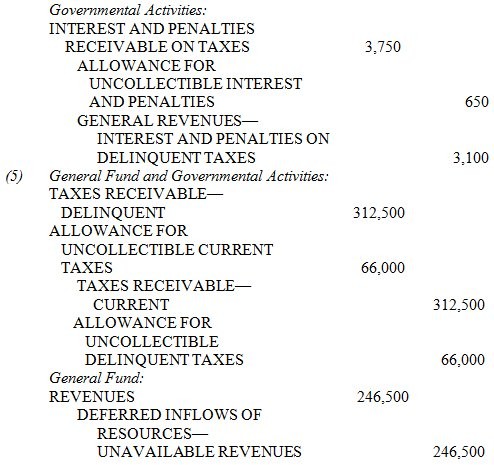

During the current year, the Town of Salo Alto recorded the following transactions related to its property taxes:1. Levied property taxes of $3,300,000, of which 2 percent is estimated to be uncollectible. 2. Collected current property taxes amounting to $2,987,500. 3. Collected $26,500 in delinquent taxes and $2,400 in interest and penalties on the delinquent taxes. These amounts had been recorded as Deferred Inflows of Resources in the prior year. 4. Imposed penalties and interest in the amount of $3,750 but only expects to collect $3,100 of that amount. None is expected to be collected this year or within 30 days of year-end. 5. Reclassified uncollected taxes as delinquent. These amounts are not expected to be collected within the first 60 days of the following fiscal

year. Prepare the journal entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

What will be an ideal response?

TOWN OF SALO ALTO-JOURNAL ENTRIES

GENERAL LEDGER

(The deferred inflow is equal to property tax revenue recognized that has not been collected [3,234,000-2,987,500].)

You might also like to view...

The disadvantage of the ______ conflict-handling style is that it is very time-consuming.

A. avoiding B. forcing C. compromising D. collaborating E. accommodating

Investors in bonds sometimes hold a _____ option, meaning they can force the issuing company to repay the bonds prior to maturity under specified contractual conditions

a. convertible b. call c. put d. serial e. short-term

The user of a(n) ______ conflict style attempts to resolve conflict by passively giving in to the opposing side.

A. negotiating B. avoiding C. forcing D. accommodating

When François the Foreigner considers the expected return on dollar deposits in terms of foreign currency, the expected return must be adjusted for

A) any expected appreciation or depreciation of the dollar. B) the interest rates on foreign deposits. C) both A and B of the above. D) neither A nor B of the above.