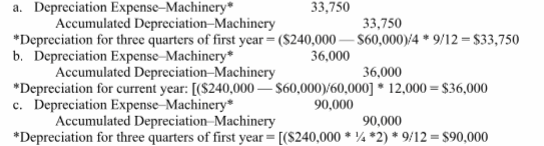

On April 1 of the current year, a company purchased and placed in service a machine with a cost of $240,000. The company estimated the machine's useful life to be four years or 60,000 units of output with an estimated salvage value of $60,000. During the current year, 12,000 units were produced.

Prepare the necessary December 31 adjusting journal entry to record depreciation for the current year assuming the company uses:

a. The straight-line method of depreciation

b. The units-of-production method of depreciation

c. The double-declining balance method of depreciation

You might also like to view...

Which is the best technique for communicating with a supervisor?

a. ingratiation b. gatekeeping c. advocacy d. There is no one best way to communicate with your supervisor.

Deciding the key message of a speech is what step in the speech preparation process?

a. Determining the general purpose b. Analyzing the audience c. Planning how to get out of the speech assignment d. Organizing the speech e. Identifying the central idea

Deferrals are recorded transactions that delay the recognition of an expense or revenue

Indicate whether the statement is true or false

Norman Co. had $5,925 million in sales and $1,155 million in ending accounts receivable for the current period. For the same period, Opal Co. reported $5,885 million in sales and $790 million in ending accounts receivable. Calculate the days' sales uncollected for both companies as of the end of the current period and indicate which company is doing a better job in managing the collection of its receivables.

What will be an ideal response?