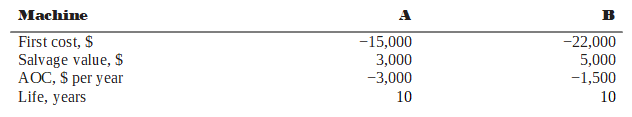

AAA Pest Control uses the following: before-tax MARR = 14% per year, after-tax MARR = 7% per year, and Te = 50%. Two new spray machine options have the following estimates and will generate the same GI each year.

Select A or B under the following conditions using the method described or as instructed:

(a) Before-tax PW analysis using spreadsheet functions.

(b) After-tax PW analysis using classical SL depreciation over the 10-year life using hand solution.

(c) After-tax PW analysis using MACRS depreciation with a 5-year recovery period using a spreadsheet. Assume the machines will be retained for 10 years, then sold at the estimated salvage values.

(a) Function for PWA: = -PV(14%,10,-3000,3000) – 15000 displays PWA = $-29,839

Function for PWB: = -PV(14%,10,-1500,5000) – 22000 displays PWA = $-28,475

Select B with a slightly higher PW value.

(b) All AOC estimates generate tax savings; GI estimates are equal.

Machine A

Annual depreciation = (15,000 - 3,000)/10 = $1200

Tax savings = (AOC + D)(0.5) = 4200(0.5) = $2100

CFAT = -3000 + 2100 = $-900

PWA = -15,000 - 900(P/A,7%,10) + 3000(P/F,7%,10)

= -15,000 - 900(7.0236) + 3000(0.5083)

= $-19,796

Machine B

Annual depreciation = (22,000 – 5000)/10 = $1700

Tax savings = (1500 + 1700)(0.50) = $1600

CFAT = –1500 + 1600 = $100

PWB = –22,000 + 100(P/A,7%,10) + 5000(P/F,7%,10)

= –22,000 + 100(7.0236) + 5000(0.5083)

= $–18,756

Again, select B with a slightly higher PW value.

(c) Again, select machine B. All methods give the same conclusion

figure 3.png)

By hand, if needed:

MACRS with n = 5 and a DR in year 10, which is a tax, not a tax savings.

Tax savings = (AOC + D)(0.5), years 1-6

CFAT = -AOC + tax savings, years 1-10.

figure 3.png)

FIGURE 4.png)

ANSWER.png)

You might also like to view...

Often the most difficult aspect of an emergency situation is _____.

a. fire prevention and control b. explosion hazards c. coordination and communication d. chemical hazards

The boiling temperature and its relationship to the system exist in the ____.

A. coil B. thermostat C. condenser D. evaporator

An automotive repair shop is valued at $475,000. If the tax rate in the community is 25.4 mills based on the assessed valuation, how much is the owner taxed?

Fill in the blank(s) with the appropriate word(s).

Why could it be a problem to start a motor in fast speed mode?

What will be an ideal response?