A general sales tax comes close to _____

a. meeting the budget needs of state governments

b. approximating a consumption tax

c. approximating an income tax

d. a perfectly regressive tax

c

You might also like to view...

If a government had a debt of $300 billion and then ran deficits of $200 billion each year for the next three years, by the end of the third year its total debt would be

A) -$300. B) $300 billion. C) $600 billion. D) $900 billion.

In the above figure, which of the following statements is FALSE?

A) The total fixed cost curve is curve C. B) Total variable cost and total cost both increase as output increases. C) Marginal cost is equal to the slope of curve A. D) The vertical gap between curves A and B is equal to average fixed cost.

A decrease in wealth would shift the:

A) aggregate demand curve rightward. B) aggregate demand curve leftward. C) aggregate supply curve rightward. D) aggregate supply curve leftward.

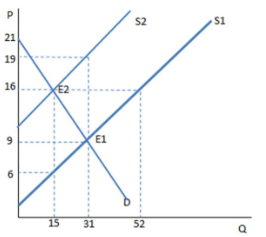

Suppose a tax on sellers has been imposed in the graph shown. What is the total tax paid per unit of the good?

A. $16

B. $6

C. $10

D. $15