Reductions in personal income tax rates that increase labor supply and work effort, can be expected to also

a. decrease consumption spending.

b. increase consumption spending.

c. decrease investment spending.

d. increase export sales.

B

You might also like to view...

Compared to a tariff, an import quota, which restricts imports to the same amount as the tariff, will leave the country as a whole

A) worse off than a comparable tariff. B) not as bad off as a comparable tariff. C) about the same as a comparable tariff. D) Any of the above can be true.

If in the economy, business saving equals $240 billion, household saving equals $15 billion and government saving equals -$150 billion, what is the value of national saving?

A. $265 billion B. $250 billion C. $105 billion D. $415 billion

In an economy, the government wants to decrease aggregate demand by $48 billion at each price level to decrease real GDP and control demand-pull inflation. If the MPC is 0.75, then it could

A. increase taxes by $24 billion. B. decrease government purchases by $16 billion. C. decrease government purchases by $10 billion. D. increase taxes by $16 billion.

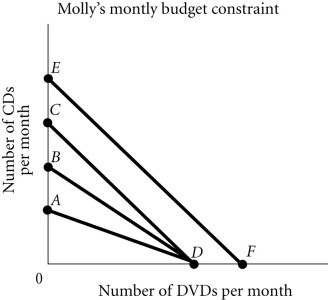

Refer to the information provided in Figure 6.5 below to answer the question(s) that follow. Figure 6.5Refer to Figure 6.5. Molly's budget constraint is EF. If her income decreases while the price of the goods are unchanged, her new budget constraint could be

Figure 6.5Refer to Figure 6.5. Molly's budget constraint is EF. If her income decreases while the price of the goods are unchanged, her new budget constraint could be

A. BD. B. CD. C. AD. D. Her new possible budget constraint is not shown on this graph.