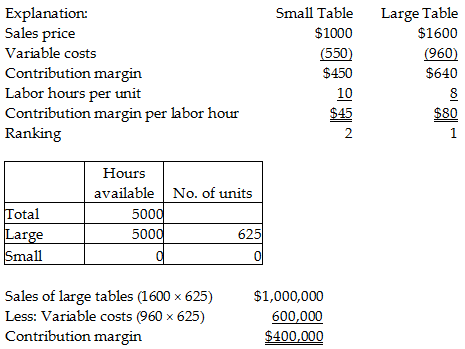

Modern Living Furniture manufactures a small table and a large table. The small table sells for $1000, has variable costs of $550 per table, and takes 10 direct labor hours to manufacture. The large table sells for $1600, has variable costs of $960, and takes eight direct labor hours to manufacture. The company has a maximum of 5000 direct labor hours per month when operating at full capacity. If there are no constraints on sales of either of the products and the company could choose any proportions of product mix that they wanted, the maximum contribution margin that the company could earn will be ________.

A) $1,000,000

B) $600,000

C) $1,600,000

D) $400,000

D) $400,000

You might also like to view...

Which of the following actions is performed during the final stage of an effective social media plan?

a. Setting objectives that can be specifically accomplished through social media b. Examining trends and best practices in the industry c. Listening to customers and understanding their expectations d. Making changes to a newly implemented campaign based on consumer response

Assume that the expectations theory holds, and that liquidity and maturity risk premiums are zero. If the annual rate of interest on a 2-year Treasury bond is 10.5 percent and the rate on a 1-year Treasury bond is 12 percent, what rate of interest should you expect on a 1-year Treasury bond one year from now??

A. ?9.0% B. ?9.5% C. 10.0%? D. ?10.5% E. ?11.0%

Two companies with the same margin of safety in dollars will also have the same total contribution margin.

Answer the following statement true (T) or false (F)

Pettijohn Inc.The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

Balance Sheet (Millions of $) Assets2016 Cash and securities$ 1,554.0 Accounts receivable9,660.0 Inventories 13,440.0 Total current assets$24,654.0 Net plant and equipment 17,346.0 Total assets$42,000.0 Liabilities and Equity Accounts payable$ 7,980.0 Notes payable5,880.0 Accruals 4,620.0 Total current liabilities$18,480.0 Long-term bonds 10,920.0 Total liabilities$29,400.0 Common stock3,360.0 Retained earnings 9,240.0 Total common equity$12,600.0 Total liabilities and equity$42,000.0 Income Statement (Millions of $)2016 Net sales$58,800.0 Operating costs except depr'n$55,274.0 Depreciation$ 1,029.0 Earnings bef int and taxes (EBIT)$ 2,497.0 Less interest 1,050.0 Earnings before taxes (EBT)$ 1,447.0 Taxes$ 314.0 Net income$ 1,133.0 Other data: Shares outstanding (millions)175.00 Common dividends$ 509.83 Int rate on notes payable & L-T bonds6.25% Federal plus state income tax rate21.7% Year-end stock price$77.69 Refer to the data for Pettijohn Inc. What is the firm's market-to-book ratio? A. 0.56 B. 0.66 C. 0.78 D. 0.92 E. 1.08