Explain the difference between a money-market deposit account and a money-market mutual fund.

What will be an ideal response?

A money market mutual fund is offered through a financial investment company and investors buy shares in the fund. Such funds invest in short-term (less than one year) credit instruments such as Treasury bills and short-term certificates of deposit that are known as money-market instruments. The money-market deposit account is a type of savings account offered by banks and thrifts that pool individual deposits to buy a variety of short-term securities. These accounts have minimum balance requirements and limit how often money can be withdrawn. Because they are bank accounts, however, they are insured by the relevant deposit insurance fund.

You might also like to view...

Savings accounts are also known as

a. M3 money b. time deposits c. demand deposits d. money market deposit accounts e. noninterest bearing M1 money

Which of the following is not an argument against free trade?

A. Diversification and defense B. Comparative advantage C. Dumping by monopolistically inclined exporters D. Infant industries

When a second firm enters a monopolist's market:

A. the former monopolist's average cost decreases as its output level decreases. B. the demand curve facing the former monopolist shifts to the right. C. the market price falls. D. None of these

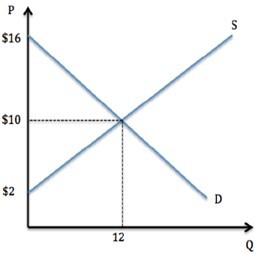

Assume the market was in equilibrium in the graph shown. If the market price gets set to $7, which of the following is true?

Assume the market was in equilibrium in the graph shown. If the market price gets set to $7, which of the following is true?

A. Some producers lose surplus, but total surplus rises. B. Some producers gain surplus, but total surplus falls. C. Some consumers lose surplus, but total surplus rises. D. Some consumers gain surplus, but total surplus falls.