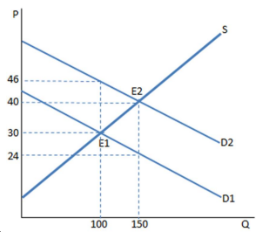

The graph shown portrays a subsidy to buyers. The subsidy causes:

A. 50 more units to be sold in this market.

B. 150 more units to be sold in this market.

C. 100 fewer units to be sold in this market.

D. 50 fewer units to be sold in this market.

A. 50 more units to be sold in this market.

You might also like to view...

The goal of antitrust acts is to

A. protect consumers. B. protect firms. C. limit profits of companies. D. reduce competition.

A property tax payment made by the owner of an apartment building is a

A) cost irrelevant to rent-setting decisions because it is not affected by supply and demand. B) marginal cost of continuing to own the building. C) marginal cost of supplying rental space. D) marginal overhead cost and will therefore affect rental rates. E) sunk cost and therefore cannot affect rents even in the long run.

To the investor, stocks are riskier than bonds because

A. interest rates fluctuate more than stock prices. B. dividends and capital gains depend on profits. C. speculators manipulate stocks but not bonds. D. dividends are taxed twice.

The earned income tax credit (EITC) has been a successful anti-poverty policy by encouraging participation in the workforce.

Answer the following statement true (T) or false (F)