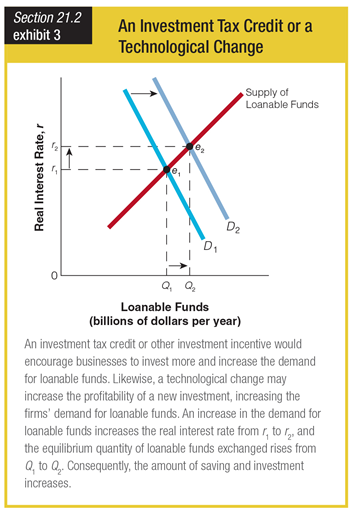

Based on the graph showing the effects of an investment tax credit or a technological change, enacting an investment tax credit would ______.

a. create a higher equilibrium quantity of loanable funds exchanged

b. create a lower equilibrium quantity of loanable funds exchanged

c. have no influence on the equilibrium quantity of loanable funds exchanged

d. drive the equilibrium quantity of loanable funds exchanged to zero

a. create a higher equilibrium quantity of loanable funds exchanged

You might also like to view...

The textbook defines a "large" business as having assets in excess of

A) $50 million. B) $150 million. C) $500 million. D) $1 billion.

According to the U.S. Supreme Court's 1945 ruling on Alcoa,

a. all monopolies are illegal b. price fixing agreements are illegal under the rule of reason c. small firms can be found to be in violation of the Sherman Antitrust Act d. "mere size is no offense." e. possession of market power is sufficient for a firm to be found in violation of the Sherman Antitrust Act

The payroll tax represents

a. the largest source of revenue in the federal budget. b. the second largest source of revenue in the federal budget. c. the third largest source of revenue in the federal budget. d. the largest source of revenue in state government budgets.

The reserves of financial institutions:

a. Are assets that financial institution's try to keep at the legal limit. b. Are made up mainly of government securities and high quality corporate bonds. c. Include the liability called "Borrowing from the central bank." d. None of the above is correct. e. Are the largest liability in a financial institution's balance sheet.